To file a claim or not?

In the complex and changing insurance industry of today, filing a claim can be extremely difficult to navigate.

There a few things to consider when filing a claim on your home, auto or business:

Has your policy coverage changed? Certain exclusions, deductibles, coverage and specific requirements are now on many policies where they once were not.

Eligibility for future policies? Will your carrier drop you when you file a claim? How many claims per time period are you allowed to have?

How much will it cost me to file a claim versus repair? Have you noticed that the cost to repair something on an insurance claim costs a lot more than if you didn’t have insurance? Many companies increase those costs for the insurance company to pay a higher amount. This accounts for the higher increase of cost to repair and may make more sense to pay out of pocket and avoid the claim on your insurance history.

As always, we are here to be a resource to you to help navigate the process of #claims.

Hemp & Cannabis Insurance

For years, the cannabis industry has continued to flourish in Colorado, yet businesses operating within this space face unique challenges. Of the key considerations is insurance coverage. Cannabis insurance plays a crucial role in safeguarding businesses against risk, from property damage to product liability, but also in drawing the necessary talent. Providing policies from seed to sale, we can ensure that your equipment, product and crop can be protected, as well as offering workers compensation and Directors & Officers coverage allowing your company to thrive.

Join us for the last Hempy Happy Hour of the summer tomorrow, register here to save your spot. We strive to bring ethical service providers to our community and keep the conversations going with hemp and cannabis.

4th Annual Easter EGGstravaganza

Join us for our 4th Annual Easter celebration with pictures with the Easter Bunny, face painting, balloon animals, coloring corner and more! Please register for the event here and to sign up for your picture slot sign up here.

This community event is open to all, so bring a friend.

There will even be a guest appearance from a REAL rabbit.

Directors & Officers

D&O insurance isn’t for all businesses and nonprofits, but many organizations can benefit from this policy. If you have a board of directors, or investors the chances are high that you need a policy to cover legal costs if you are liable for a claim. This can happen if someone in the organization didn’t pay taxes, misuse of funds, or another type of fraud. Having D&O insurance is a great way to attract and retain the talent you are looking for.

If you have questions about management liability, D&O or general liability, our team is always here to walk you through the process.

Do you have employees?

If you have even one employee, there are many laws and changes that you need to think about.

Workers comp is required in Colorado to cover them for any on-the-job injuries. We can streamline the process of workers comp with Real Time Billing, allowing you to take the guess work out of payroll. With Real Time Billing, your workers comp premium is calculated based on actual payroll.

Bottom-line benefits to your business

- No down payment when purchasing coverage

- Seamless integration of payroll and policy billing

- Premiums that are less susceptible to adjustment

- Automatic payments for each pay period

- No billing fees or monthly checks

Starting on Jan 1 2022, we have an additional law to pay attention to for your employees with Colorado Paid Sick Leave.

Our friends at Payroll Vault North Metro Denver has provided some great information, feel free to reach out to them as they offer support to businesses around the Denver area and can easily assist with our billing options for Workers Comp.

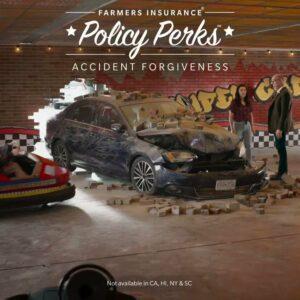

State Minimums and Car Insurance: How Much Insurance Do I Need?

Each state has certain minimum requirements when it comes to car insurance. With low monthly rates, sticking with these state minimums can be tempting. But is this coverage enough?

Insurance is designed to protect people when the unimaginable happens. No one wants to consider the possibility of a serious accident or the consequential events that may occur. However, as insurers, we must take these possibilities into account. Minimal coverage is exactly what it sounds like, minimal. In the event of an accident, state minimums may not be adequate enough to cover all expenses and you would be held liable for damages. Those additional expenses can turn into a lawsuit, and one may find themselves in a complicated financial position.

In Colorado, our state minimums are $25,000 for bodily injury per person, $50,000 for bodily injury per accident and $15,000 for property damage per accident (25/50/15). These are liability limits that will only cover the damage you cause another driver and/or property owner.

As insurers, what do we recommend?

Bump up your liability insurance to at least 100/300/100. This should be the bare minimum to protect your assets.

Add comprehensive and collision insurance. This will protect your vehicle from damages that occur from an accident and other events such hail, theft, vandalism, contact with animals, etc.

Add uninsured/underinsured motorist coverage. This coverage is important to protect you from underinsured or uninsured motorists on the road.

Add medical payments or personal injury protection (PIP). This will cover lost wages, and treatment of any injuries sustained by you or other passengers in your vehicle. Medical payments can be used right away for costs like an ambulance, or physical therapy. And it does not need to be paid back.

Add an umbrella policy. The umbrella will extend your liability limits to $1M on your car, toys and home in the event of a claim. This can be increased as well.

If you are looking to add these coverages but want to keep your lower costs, let’s look at raising your deductible or bundling your policies to help save on your premium.

Proper insurance coverage will protect your assets, as well as future earnings which is priceless!

Are your minor children listed as beneficiaries for your life insurance?

Did you know?

If you list your minor children as beneficiaries of your life insurance policies, it will go through probate and the state could appoint a legal guardian which is a lengthy and costly process. And even if your estate plan consists of a will alone, you are guaranteeing your family will have to go to court if you become incapacitated or pass away.

September was Life Insurance Awareness Month and we were thrilled to bring an expert to you, our valued friends, clients and colleagues for a free Wills, Trusts and Wellness Webinar, with estate attorney, Pamela Maass.

Pamela Maass is an Estate Planning and Asset Protection Attorney from Law Mother helping Colorado families and business owners protect their future and loved ones. She focuses on estate planning, wills, trusts and asset protection. She will be discussing:

- Why you need Estate Planning and where to begin.

- How to choose the right guardians for your children and make sure your children are never taken from your home or placed with strangers if something happens to you.

- Should you be concerned about estate taxes?

- Why a will alone is simply not enough to make sure your kids are taken care of the way you want, by the people you want, not matter what.

You can watch the event here and please reach out to Pamela for more information. As always, send your life insurance questions our way to make sure you, your family and your business are always set up for success.

Denver’s Health and Wellness Festival

Come celebrate Life Insurance Awareness Month by celebrating your physical strength, as well as your financial strength. Life insurance is important the younger and healthier you are. Register in the bio for some fun and increase your strength all the way around!

https://feverup.com/m/101908

Sip, Style & Shoot, a women’s headshot event

Join your favorite ladies for Sip, Style & Shoot on June 19, 2021. Enjoy bubbles, bites and getting styled by the experts at Stitch Boutique.

Join your favorite ladies for Sip, Style & Shoot on June 19, 2021. Enjoy bubbles, bites and getting styled by the experts at Stitch Boutique.

$19 suggested donation for a professional headshot goes directly to Sistah.biz, empowering black female entrepreneurs, 19% off your total purchase at Stitch Boutique. Sign up is require and will go quickly, please use the link to register.

We can’t wait to see you in person again!

This event is sponsored by:

Abby McDaniel, Spire Financial

Rena Schomburg, Schomburg Insurance

Photography by: Stephanie Bassos

Bike 4 Bike Fundraiser

We are so thankful for our community joining us to help the Andrew P Todis Memorial Bike Drive with Excalibur Outreach this year. We still need a few more bikes and helmets for elementary aged children for the last drive on June 27, 2021. If you can donate, please reach out to us for where to send the bikes or arrange a pick up or drop off with us.

Other Topics

- Agency (2)

- car insurance (1)

- Uncategorized (37)